Federal Budget 2021 Assisting First Homebuyers

With the recent announcement of various new initiatives in this year’s Financial Budget. First Home buyers are offered some relief to help them enter Australia’s red hot property market.

Treasurer Josh Frydenberg told the parliament that there will be 3 key measures to assist first home buyers with entering the property market.

Table of Contents

1. The Major Housing Schemes from the Federal Budget

2. What is the First Home Loan Deposit Scheme?

3. Eligibility criteria for First Home Loan Deposit Scheme

4. What is the Family Home Guarantee?

5. Eligibility criteria for Family Home Guarantee

6. What is the First Home Super Saver Scheme?

7. Eligibility criteria for First Home Super Saver Scheme

8. Predictions for the property market

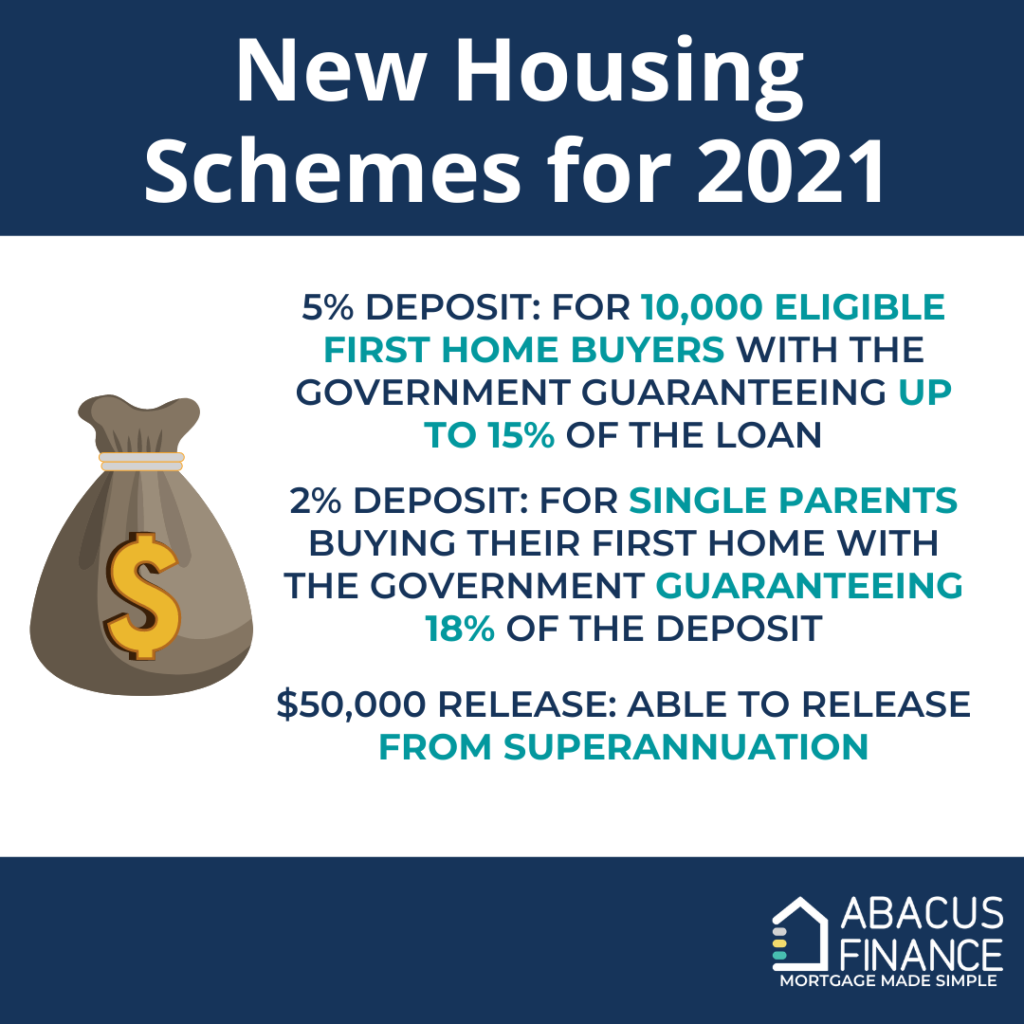

The Major Housing Schemes from the Federal Budget

What is the First Home Loan Deposit Scheme?

“The high participation of first home buyers in the property market is likely contributed by the First Home Loan Deposit Scheme” – says CoreLogic head of research Eliza Owen.

So what is this scheme, and how is it benefiting first home buyers(FHB) at the moment?

Introduced by the Australian Government to help support eligible FHBs purchase their first home sooner.

Under this scheme, first home buyers will only need a 5% deposit with the government acting as their guarantor for the remaining 15%.

An additional 10,000 FHB applicants will be able to apply for this scheme from 1 July 2021.

Eligibility criteria for First Home Loan Deposit Scheme

To learn more about the eligibility criteria for this scheme. This scheme is available from 1 July 2021 to 30 June 2022.

What is the Family Home Guarantee?

Aimed at providing single parents with the opportunity to build a new home or purchase an existing home with a just a deposit for 2%.

The Australian Government will make this scheme available for 10,000 single parents from 1 July 2021. Over the next four financial years.

Eligibility criteria for Family Home Guarantee

Regardless if the single parent is a first home buyer or a previous owner-occupier. Applicants must be an Australian citizen, at least 18 years of age and have an annual taxable income of a maximum of $125,000. Discover your eligibility here.

What is the First Home Super Saver Scheme?

This scheme allows eligible first home buyers to release voluntary super contributions to go towards a house deposit.

From 1 July 2021, buyers will be able to release up to $50,000 of their super. Any super contributions made by employers and spouse contributions can’t be release under the scheme.

Eligibility criteria for First Home Super Saver Scheme

From 1 July 2021, you can apply to release your voluntary contributions from your superannuation, to help purchase your first home. You must meet the legibility requirements to apply for this release.

Predictions for the property market

With all these incentives being pushed out into the property market, there are fears that this will serves to push prices higher overall.

Shane Oliver, AMP Capital chief economist said the recent Federal Budget announcements

Treasurer Josh Frydenberg told the parliament that there will be 3 key measures to assist first home buyers with entering the property market.