Current fixed-rate mortgage owners must brace for revert rates

Fixed-rate mortgages give homeowners immunity from rate hikes or any erratic market movement throughout the life of their loan. Generally, fixed rates have higher interest rates compared to variable rate loans. And that is because part of what you sign up for is the peace of mind of knowing exactly what to pay for every month. However, that is pretty much it, all terms are bound to end and the revert rate is waiting.

Fixed-rate loans usually last for a maximum of five years. Once the term is over, a revert rate is waiting. The revert rate banks give to former fixed-rate loan owers is generally higher than the current rate they give to new customers.

According to a recent study by RateCity, current fixed-rate mortgage owners could be in for a surprise when they come off their mortgage. If you own one and are about to come off it soon, brace yourself. Currently, 38% of mortgages are fixed. Most of them will end in the middle or end of 2023. Last year saw the peak of the popularity of fixed-rate mortgages.

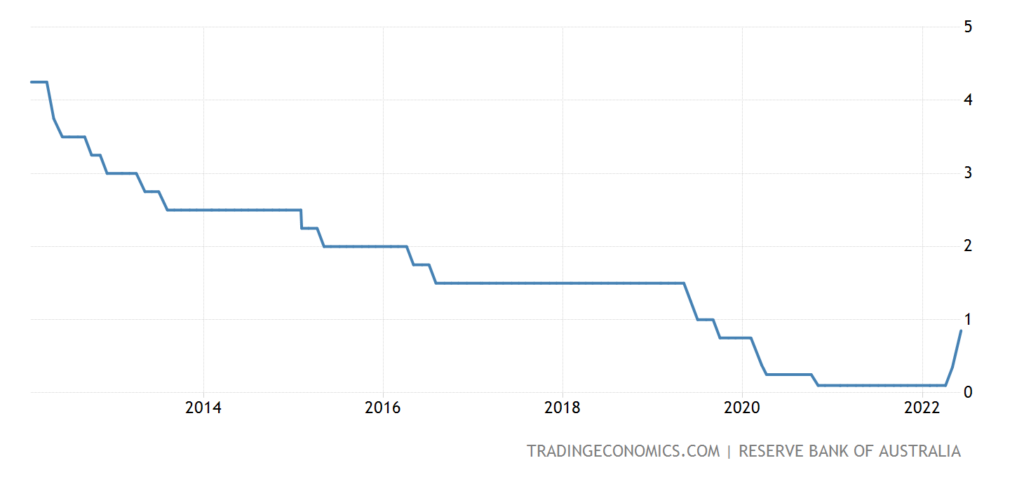

There has been a series of hikes in the official cash rate. The last one was a 50-basis-point increase bringing the official cash rate to 0.85%. You won’t fee the burn right now under the comfort of fixed rates.

RateCity found that if you are part of the 38% whose fixed-rate shield ends next year, you could be looking at a 45% increase in repayments. So, if you took out a $500,000 loan in July 2021 on a 2-year term, you are currently paying $2,105 monthly. On a revert rate, your monthly repayments could shoot up to $3,042 at 5.68%. That is an extra $937 slashed from your monthly budget.

How do you prepare for this?

No one wants a 45% increase in their monthly mortgage repayments. So as early as now, you have to look into different options available to you once your term ends. And yes, saying yes to the revert rate is not the dead-end.

Find out how many repayments you can do

While you still have a good few months on your current low-interest rate, take advantage of repayments. Fixed-rate loans don’t usually come with friendly extra repayments perks. But if yours do come with some window for some, do your best to put in the cash.

You don’t only pay less in interest rates, but you also lower the remaining amount you owe the bank. Making the remaining balance smaller means the new interest rate will only be applied to that smaller remaining amount.

Renegotiate with your bank or switch

When your term ends, you can refix. This usually means you have to pay a fee to afford the fixed interest rate privileges. Or you can also try to renegotiate your loan.

Check if you can switch lenders without having to pay break fees. Some offer this if the customer passes a serviceability test. Or you can also shop for promos and offers on switching. Some lenders reward their customers for jumping ships.

Don’t limit yourself to your current bak and what they offer. The mortgage industry is a competitive one. You will always find an alternative.

Overall, you just need to be prepared by checking your options early on. Before your term expires, your bank will call you and explain what your options are. From there, you can start chopping and competing for the best deal in the market.

Call your broker when you decide to start shopping or if you are confused about your next step. Just like when you first applied for the loan, your broker will guide you as well this time.