A New Way To Think About Debt in 2021

When people think about debt, they often see all of it as being bad. However, there’s probably plenty you may not know when it comes to the relationship between good vs bad debt.

The reason I want to talk about debt now is that designing the life you love will involve debt. It’s important to be aware that there is good debt, bad debt and neutral debt and how you act with each of them should be different.

One of the most important factors that determine the success or failure of an investment in your relationship is debt. The reason is simple, if you want to achieve financial freedom through your assets, then an appropriate level of “loan” is an essential part. How you treat and manage debt is critical to your investment results.

Having a lack of understanding of the true value of debt leads investors to often end up in failure with their investments.

Contents List

5. Improving your relationship with debt

What is bad debt?

“Bad debt” refers to borrowing money and investing it into assets that will depreciate or expensive debts that drag down your financial situation. Products purchased with bad debt will never generate a positive return. Late payments will incur penalty interest. Additionally, your outstanding balance will also increase, and your compound debts will begin to spiral out of control.

An example of bad debt is:

Purchasing a designer handbag that is charged to your credit card, but you don’t pay off, or a trip to Europe that you finance with a home equity line of credit or personal loan.

The long-term effect of having a relationship with bad debt is that it will affect your credit rating, even if you escape its control.

A list of bad debt

The good thing is, bad debt is quite easy to distinguish once you know what you’re looking for. It’s the kind of debt that continues to make your life more and more difficult.

Neutral debt list

They are not debts that can be distinguished from good and bad, but debts that may become better or worse depending on the specific usage.

For example Owner-occupied housing loan

Housing loans can of course bring cash flow, but also bear the cost of housing ownership, but it cannot be considered a bad debt. The loan amount and rent may be seen as an impact on household cash flow.

In addition, changes in the house market price will bring about the rise and fall of household assets. So, to examine whether this loan is good or bad, you may want to consider the monthly repayments and the change in house prices.

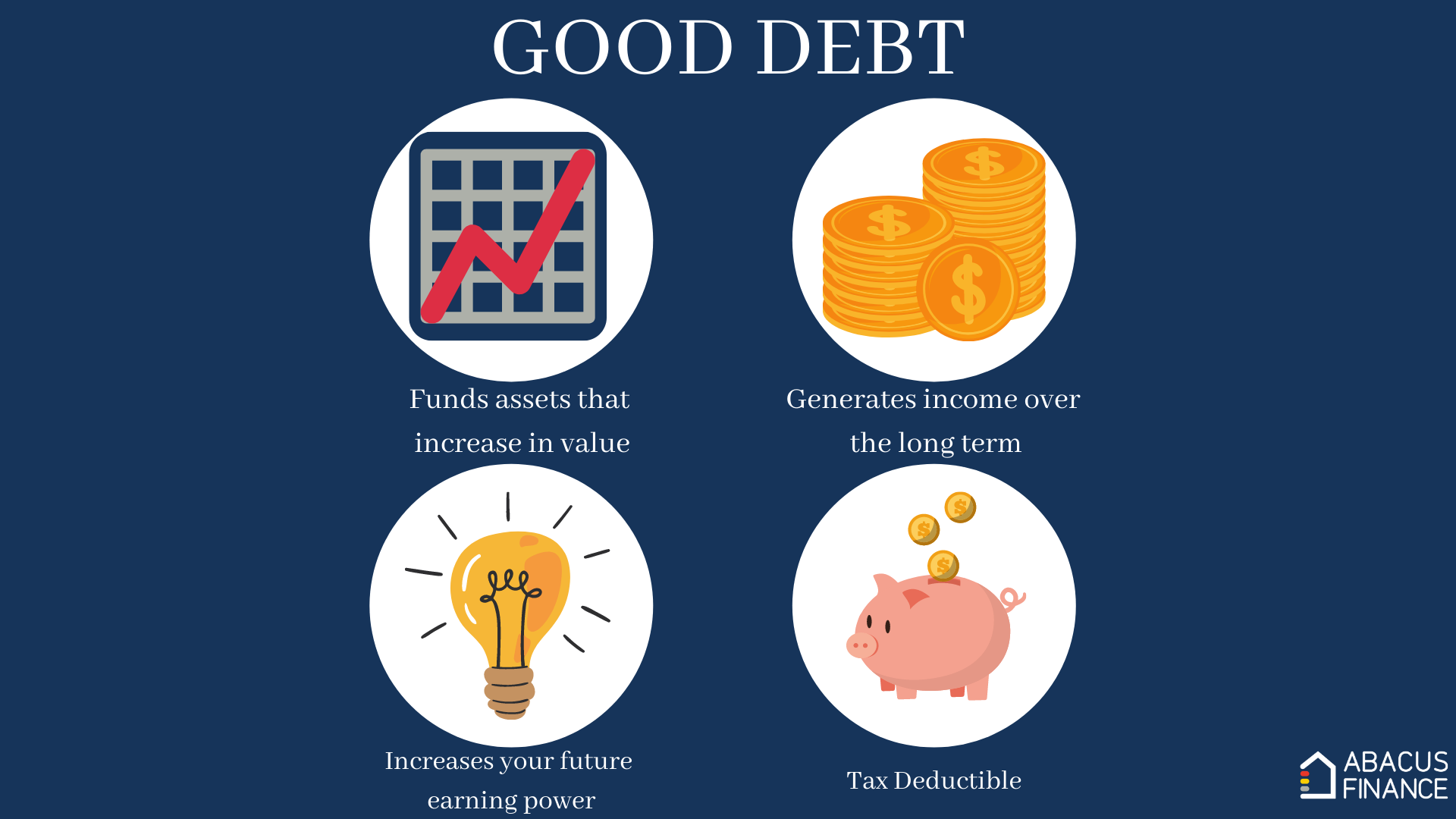

What is “good debt”?

Don’t worry not all debt is bad debt. Borrowing funds to purchase assets that accumulate wealth is known as good debt. Some will continue to provide cash flow income.

E.g., If you borrow funds at a 3.5% interest rate to buy a property with an annual capital growth rate of 6% and a net rental yield of 3%, your assets will continue to increase. (If compound interest and leverage are including, the advantage is even greater)

Borrowing money to invest in growth assets with sufficient rental income means you can accumulate a larger investment portfolio. This is much greater than the benefits you can get if you don’t use loan funds.

Improving your relationship with debt

Everyone who plans to accumulate wealth through investments needs to use debt, but ‘debt’ is often demonised.

“Remember it takes money to make money”

It’s recommended we embrace debt and understand the true value it provides for your investment strategy.

3 Tips To Manage Debt

- The amount of the debt must be within the scope of the repayment ability. Once the payment is overdue, it will not only cause late payment but also may leave a stain on your credit report

- Develop a reasonable debt management plan, formulate a clear schedule of repayment time, and strictly implement it to manage debt

- When deciding to borrow, in addition to confirming the interest rate, it is also necessary to confirm the total cost of borrowing.

Abacus Finance

At Abacus Finance, we’re no strangers to the homeowner’s journey. It’s a long but rewarding one.

But don’t worry, we are here to help with that.

If you’re thinking of buying a home, you can chat with us today and seek advice about the best options for you when it comes to your mortgage. The cost of your mortgage can drastically affect your financial planning, so it pays to speak to the experts about it.

The information in this post is general in nature and should not be considered personal or financial advice. You should always seek professional advice or assistance before making any financial decisions.