How does Credit Impact Your Loan Application? – 4 Useful Tips To Boost Your Credit Score

There may be a higher price to pay for all the coffees you’ve bought this week or the takeout meals you ordered through UberEATS.

You better watch out as the banks have a close eye on your daily spending habits if you’re a potential loan customer – purchases made through Afterpay, food deliveries, daily splurges and entertainment are all being put under the microscope.

In short, your credit score is being put to the test as it how shows how reliable you are in making repayments to your bank/lender. It is calculated from your personal and financial information in your credit report. Having a higher score will maximise your chances for a better loan.

Contents List

1. How Your Credit Score Is Calculated?

2. So What Even Affects Your Credit Score?

3. 4 Simple but Effective ways to Boost your Credit Score

4. Why Mortgage Brokers are your next best friend

How Your Credit Score Is Calculated?

Your overall credit rating is calculated based on what’s in your credit report. For example, this includes

- Repayment history

- Overdue accounts

- Details of the credit or loan products you’ve held in the past

- Number of credit enquiries

- Court judgements

- Debt agreements and bankruptcies

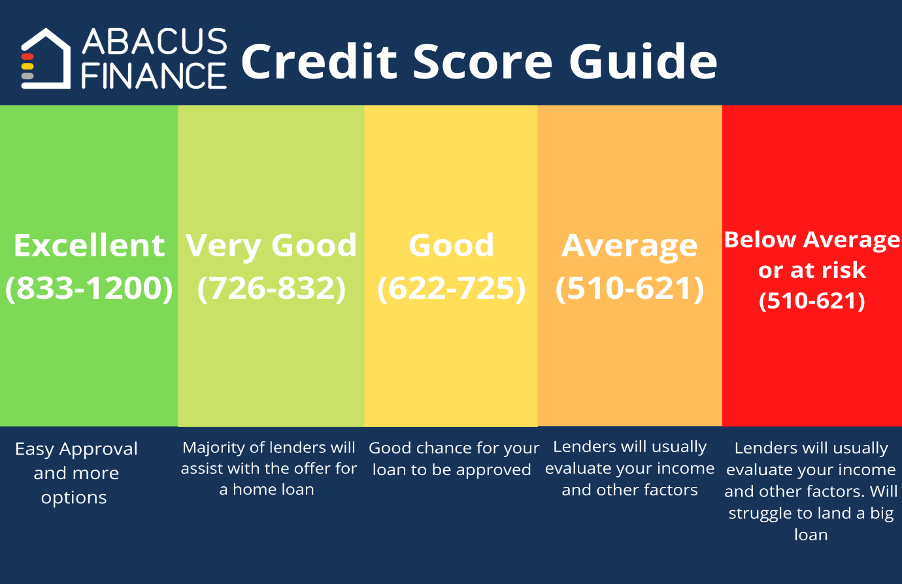

Generally, your credit score could be scored between 1 to 1200 from the credit reporting agency.

The score reflects a perceived risk factor that a lender assesses, before lending you money. A higher score means the lender considers you a lower risk. The lower the risk, the more likely you are to have your loan approved.

So, What Even Affects Your Credit Score?

There are numerous things that can affect your overall credit score whether it’s for the better or the worse. We have provided a short but effective infographic to give you a perspective of what can change your score.

4 Simple but Effective ways to Boost your Credit Score

1. No more late repayments

The easiest way to improve your overall credit score is to ensure that you make your repayments on time and that there are no overdue payments. Any overdue payments will remain on your credit report and will ultimately badly affect your credit score.

2. Addressing any discrepancies in your credit report

It is a good idea to order a copy of your credit report to check for any incorrect information. You could be surprised at what you might discover. Any changes that can benefit your crediting rating may improve the number of lenders that can accept your loan application.

In relation to personal information being incorrect on your credit report, it is suggested that you contact Equifax to discuss these details. If there are any amendments you would like to discuss, you may want to contact your lender to go over what is the best course of action.

Example: If a creditor reports you about a payment you didn’t make, but you have the evidence to prove this mistake(Bank statement), then it should be immediately dealt with. To avoid it affecting your credit rating.

Also enquiring about your credit report will not negatively affect your score. Since it’s considered as a soft enquiry.

3. Limit your hard Inquiries

Your overall credit report will consist of either a hard or soft inquiry. Soft inquiries will not affect your overall credit score. They are unrelated to a loan or credit application. The most common soft inquiries include employers, landlords or credit card preapprovals.

However, for hard inquiries, they, unfortunately, have a negative effect on your credit score. Generally, they are applications for a new credit card, a mortgage, an auto loan or any form of new lender enquiries. Continuous hard inquiries will be viewed, from a bank’s perspective, that you might be increasing your debt levels and maybe facing financial difficulties. Avoid needlessly applying for new credit if you want to improve your credit score.

4. Lowering the limits on your credit cards

If you are someone with a high credit limit, you might consider reducing your limit as it will adversely affect your overall loan application. To learn more about how this affects your application why not give us a call to discover more.

Why Mortgage Brokers are your next best friend

Some people believe that applying for multiple home loans is the best way to gain borrowing approval. In reality, too many credit enquiries in a short period will damage your credit score and lower your chances of getting approved for a loan.

To maximise your chances of obtaining a loan, it will help to partner with an experienced mortgage broker in Australia who will analyse your needs and financial situation and who will match you to a loan and a lender.

Even our legislation will help you to make best friends with us. The beginning of 2021, the Act: “Best Interest duty” is a statutory obligation for mortgage brokers to act in the best interest of the client, when providing credit assistance. So, you know for sure that your mortgage broker is doing it just for you, because what are best friends for.

That’s why at Abacus Finance, we understand how important mortgage approval is and the implications that rejection can have on you and your family. That’s why our skilled team of mortgage brokers is committed to acting in your best interests. We will find you the right home loan that suits your unique situation– fitting to your needs, your budget and overall long-term financial goals. For a tailored experience with a home loan. Contact Abacus Finance today.

The information in this post is general in nature and should not be considered personal or financial advice. You should always seek professional advice or assistance before making any financial decisions.