Choosing The Right Car Loan To Get Yourself On The Road Sooner

Looking to take your next big holiday interstate? It may be a good time to trade in for a new set of wheels that’s affordable and easy to maintain.

Refinancing to a lower interest rate on a car loan can help you enjoy more affordable repayments, in addition to car loan features that offer the extra flexibility to suit your financial situation.

Table of Contents

3. Steps involved in the car loan process

4. Can I get a no credit check car loan?

7. How to find a suitable car loan

What is a car loan?

A car loan is a personal loan used to help buy either a new or used motor vehicle when you can’t afford the total upfront cost. You will be making monthly repayments on a fixed term towards a lump sum you borrowed, as well as interest payments.

Abacus Finance Tip: A friendly reminder is to compare car loan options available, rather than settling for what the car dealership offers. Simply considering the lowest interest rate isn’t the only factor you should be looking at.

How do car loans work?

A car loan is a financial arrangement between three parties: buyer, vendor and the lender. This loan can be used for either a new or used vehicle.

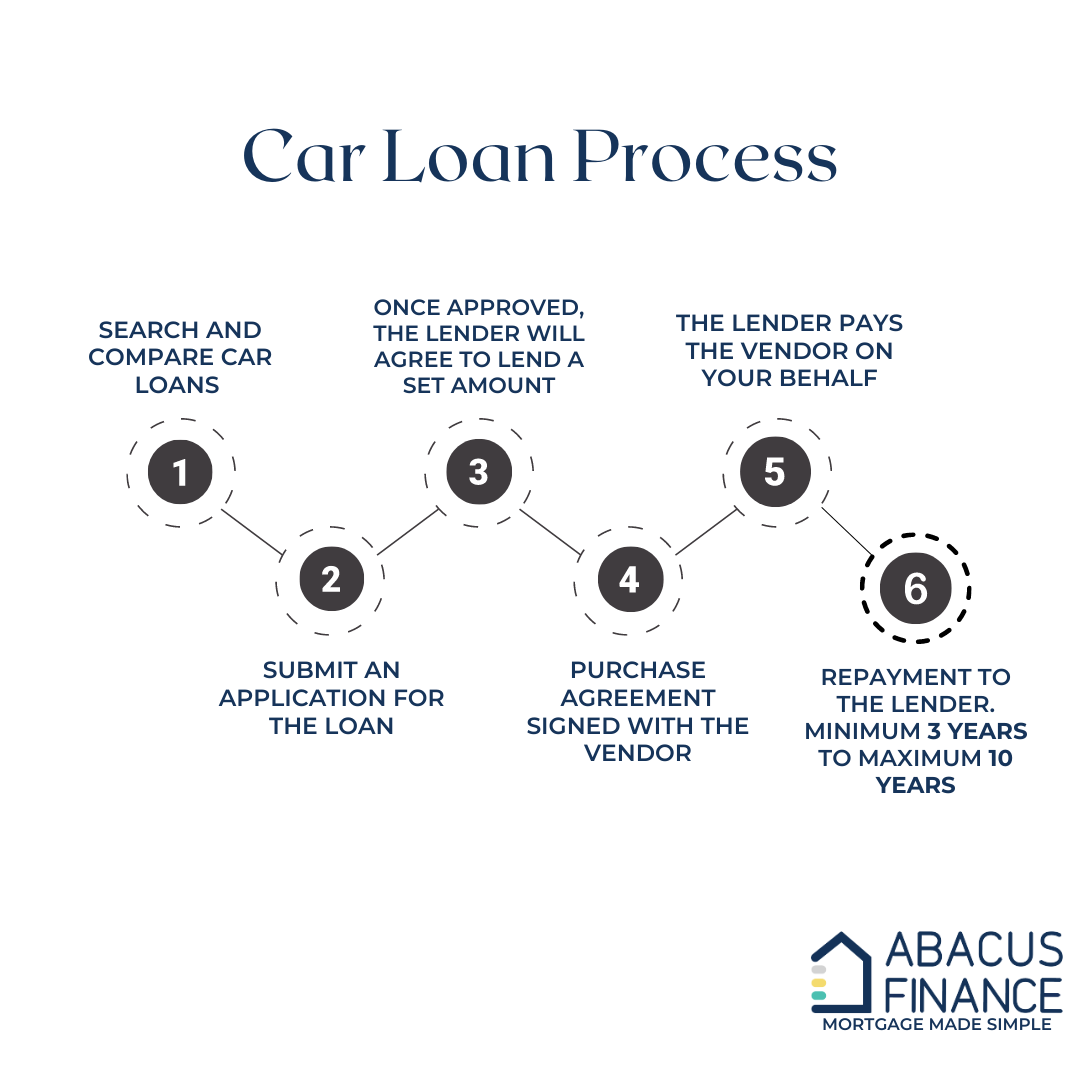

Steps involved in the car loan process

Can I get a no credit check car loan?

Some lenders in Australia, offer car loans without the need to check your credit history. However, they may charge a higher interest rate with higher fees. In these circumstances, lenders will view you as a riskier borrower and charge you a higher interest rate.

Abacus Finance Tip: Lenders that don’t consider your credit history may not be your best decision financially. Those struggling with debt will find themselves with unaffordable car loan repayments.

Secured Car Loan

A secured car loan is when the lender places the motor vehicle that you purchased for the loan as security. In this situation, if you are unable to make a repayment, the lender will be able to take possess your vehicle and sell it.

The advantage of this loan is that lenders will view this to be a less risky loan, and hopefully get you a lower interest rate.

Unsecured Car Loan

In comparison, an unsecured car loan is offered by some lenders at either a fixed or variable rate. Luckily for unsecured loans, family members can act as guarantors, to help secure the repayments for a lower rate.

It’s important to keep in mind there are several other types of car loans available besides the 2 main ones discussed earlier.

How to find a suitable car loan

With dozens of car loan dealers and lenders available in Australia, it’s important to shop around and make comparisons that factor in the price, benefits and repayment options.

Abacus Finance allows you the freedom to cut research time and help you find a product that meets your financial situation in no time.

The information in this post is general in nature and should not be considered personal or financial advice. You should always seek professional advice or assistance before making any financial decisions.