How Can Construction Loans Finance Your Dream Home in 2021?

Have a dream home in mind? Considering you have the right amount of time and the suitable land needed for this project. It would be a smart move to research your finance options before entering into a building contract.

Contents List

1. The Construction Industry During COVID-19

2. How does a construction loan work?

3. Stages of a construction loan

4. How to find a construction loan

The Construction Industry During COVID-19

Over the past 12 months, homebuyers have been given a host of Government incentives to enter the property market and a large portion of them are centred around building your own home.

Both the Federal Government and various State Governments have launched various stimulus packages on the back of COVID-19. The measures were meant to boost the building industry and it led to a boom for owners of vacant land in many states.

According to the Australian Bureau of Statistics (ABS), construction of new dwellings spiked by 11.5% in October 2020, and in conjunction with record low-interest rates, has been a major factor in confidence quickly returning to the housing market.

How does a construction loan work?

Construction loans are put in place to help with funding the building of a new home or undertaking a substantial renovation. The actual process differs slightly from a traditional loan, as well as the assessment of the loan application.

Because the home is not built yet, valuers will be required to estimate what a fully finished home might be worth. At the same time, given the shorter timeframe associated with building compared to a more traditional 30-year mortgage, the interest rates attached to a construction loan is going to be slightly higher.

A construction loan also differs from a traditional loan, in that it is normally an interest-only loan for the period that the home is being built. Notably, this is broken down into what is known as progress payments as the construction work moves forward and is based on several different stages of the build.

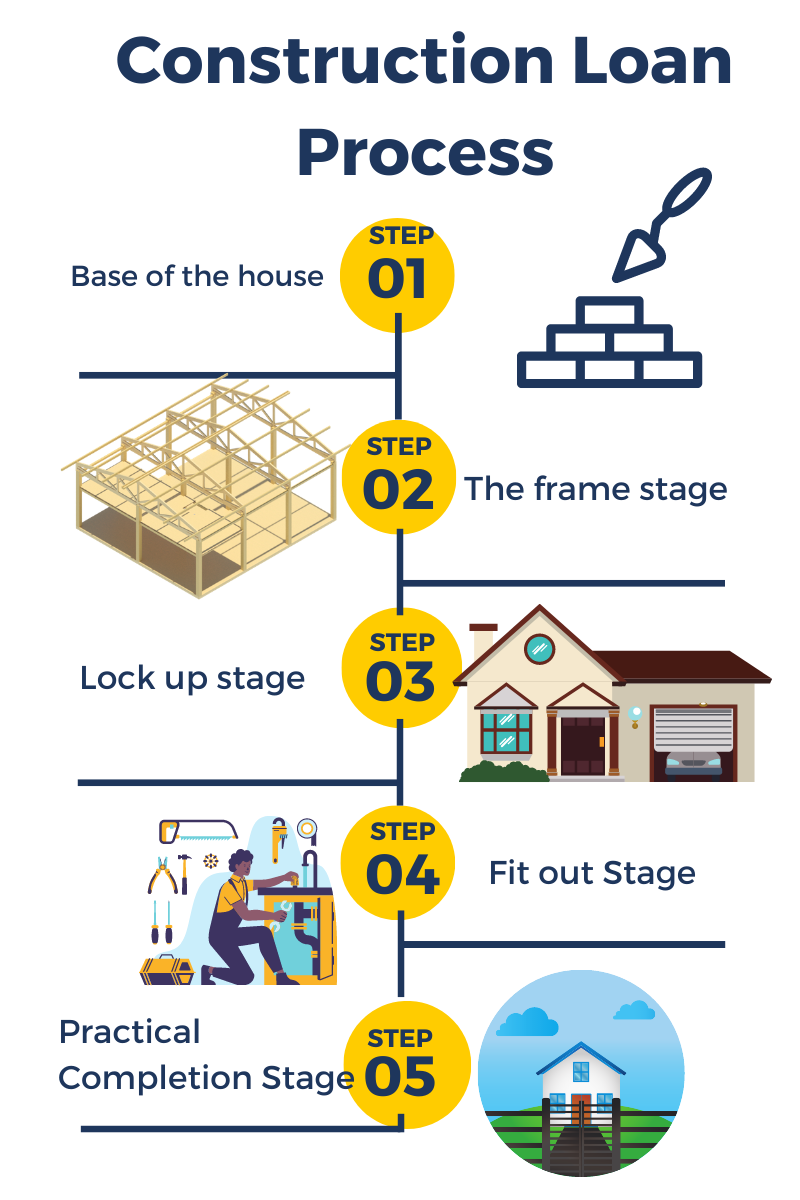

Stages of a construction loan

First Stage – This is known as the slab down or base, which covers the costs of laying the home’s foundations.

Second Stage – After the foundations are in place, the frame is assembled, and this stage is therefore known as the frame stage. This also includes roofing and brickwork.

Third Stage – Lockup occurs when the house can be physically locked. This means it is finished with the external walls and has windows and doors in place.

Fourth Stage – The fit-out stage is when the internals of the house are undertaken. This includes cupboards, shelving, tiling and flooring, as well as plumbing and electrical work.

Fifth Stage – Practical completion occurs when all the finishing touches are done, which includes painting, carpeting, installing fences, gardens and giving the property a final clean.

At the completion of the property, a construction loan will generally revert to a standard principal and interest loan, or the homeowner will likely refinance to a loan product that suits their needs. As mentioned, interest is charged only on the total amount of money that has been drawdown based on the various stage of the construction.

While many of the Government programs are now coming to an end, many first home buyer grants are available for those looking to build, so it is important to understand how construction finance works.

How to find a construction loan?

We understand that each lender has different requirements and set of conditions that need to be met. Abacus Finance offers over 40 lenders, and they range from private lenders to major banks. Assessing your financial situation will help to offer you an array of construction loan products available in the lending market. Chat with us today, to explore your opportunities in building your dream home.

The information in this post is general in nature and should not be considered personal or financial advice. You should always seek professional advice or assistance before making any financial decisions.