The Difference Between Genuine Savings and Non-Genuine Savings

Many first home buyers can often get caught out with the concept of genuine savings.

When applying for a home loan, having a deposit that you’ve saved is something that most lenders like to see. When you are able to save, it demonstrates that you are able to handle your finances, which makes you someone a bank would like to lend money to.

If you are looking to borrow more than 90% of the value of the property, then genuine savings become even more important.

If you don’t have enough money in savings to use as a deposit, then there are loan products that you can still access. The most obvious is a guarantor loan, which is when another person (normally your parents) guarantee the loan. There are even some instances where a person has paid rent for a long period of time and a lender will consider that as savings. If you have equity in another property, this is often able to be considered a deposit as well.

However, what actually constitutes genuine savings is often not straight forward and it is usually wise to have a discussion with your Abacus Finance mortgage broker early on about your situation.

Contents List

1. Abacus Finance Example: Genuine Savings

2. Abacus Finance Example: Not Genuine Savings

4. Other forms of Genuine Savings

Abacus Finance Example: Genuine Savings

Property purchase price is $1,000,000. Thus, genuine savings required is therefore $50,000 (5% of $1,000,000).

The proposed borrower has a balance of $50,000 from 6 months ago.

This would be considered genuine savings with most lenders as they have held the required 5% for the last 6 months. Since they haven’t spent it during this period either.

Abacus Finance Example: Not Genuine Savings

Property purchase price is $1,000,000. Thus, genuine savings required is therefore $50,000 (5% of $1,000,000).

The proposed borrower has a balance of $60,000 from 6 months ago.

During the last 6 months, they made one withdrawal of $27,000 for a car purchase

Recently his family had gifted a deposit of $25,000 into his account.

Starting with $60,000 then withdrew $27,000 leaving them with $23.000. This meant they were unable to meet the genuine savings amount required.

If they had received the gift from the family 6 months ago, then the following amount of $25,000 would count to the amount of their genuine savings.

Using Short-Term Windfalls

Often, home buyers might have received a large sum of money that they would like to use as a deposit. That might be something like an inheritance, a gift from their parents, a tax refund or the proceeds from the sale of an asset such as a car.

The way lenders assess genuine savings is based on how long the money has been sitting in your account. Therefore, you might be able to simply leave the money in your account and add to it for a period of three months and then the lender could very well consider that as genuine savings. The longer you have the money in your account the better.

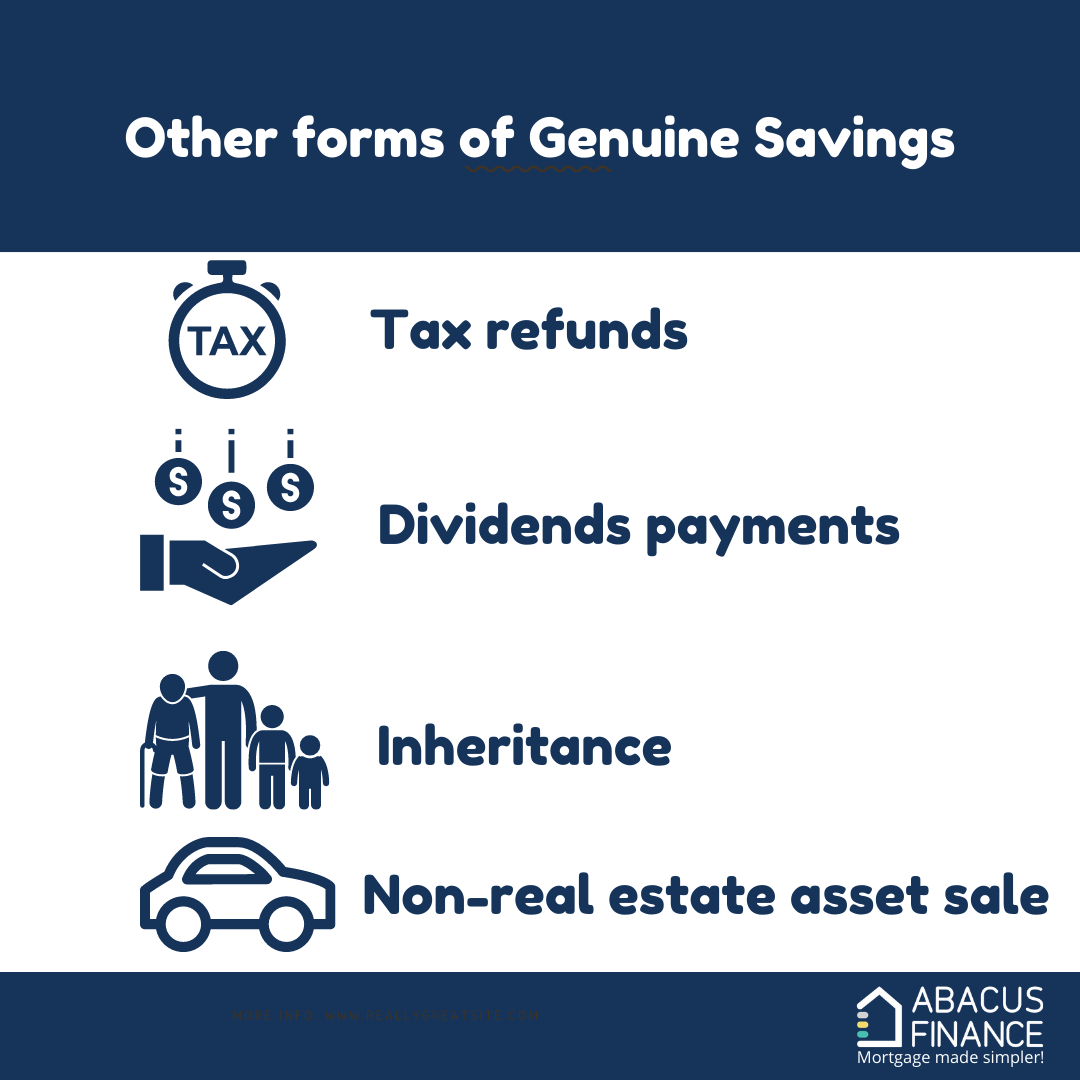

Other forms of Genuine Savings

- Dividend/Commission payments: Provide a payslip as evidence with bank account statements

- Tax refunds: Provide a copy of your Notice of Assessment

- Inheritance: Provide a letter from the Executor confirming the amount and date that the funds will be received

- Non-real estate asset sale: Provide evidence for the details of that asset that was sold. E.g. sales of car

Waiting To Buy

If you are in a position where you can wait a few months after receiving a significant sum of money you could potentially use those funds as a deposit and that will put you in a far better position.

- You will likely be able to access a wider range of lenders.

- If you can contribute more by way of savings, you could pay a lower rate of Lenders Mortgage Insurance (if you’re borrowing above an 80% LVR).

- You will likely be able to access a wider range of loan products, with higher LVRs.

Recently, the Federal Government has introduced the First Home Loan Deposit Scheme, which allows first home buyers to purchase a home with as little as 5% in genuine savings and not be required to pay LMI. In this case, the money you have saved on the LMI could well be used as a deposit.

There are a number of ways that home buyers are able to increase their genuine savings in the eyes of a lender.

The best advice we can provide to you is to speak to your local Abacus Finance mortgage broker so they can assess your situation and match you with the right lender and loan product.

The information in this post is general in nature and should not be considered personal or financial advice. You should always seek professional advice or assistance before making any financial decisions.