How Can You Access a No Deposit Home Loan?

For many first home buyers, getting a home loan with no deposit may sound like a dream come true – but is such an option available to the public?

Most lenders don’t generally offer a true ‘no deposit’ home loan.

For the few that do offer it, there are generally very strict criteria’s to be met to be eligible. This includes a nearly perfect credit record and a stable income history.

The next best thing for borrowers would be a 5% deposit home loan. Low deposit home loans usually come with extra criteria’s, so it’s important you do your research to understand the potential benefits and risks of each loan product.

Table of Contents

1. Do ‘No Deposit’ loans exist in Australia?

2. What are the alternatives to no deposit home loans?

4. A Family pledge guarantor loan

5. First Home Loan Deposit Scheme

6. How can we help you to reach your goals?

Do ‘No Deposit’ loans exist in Australia?

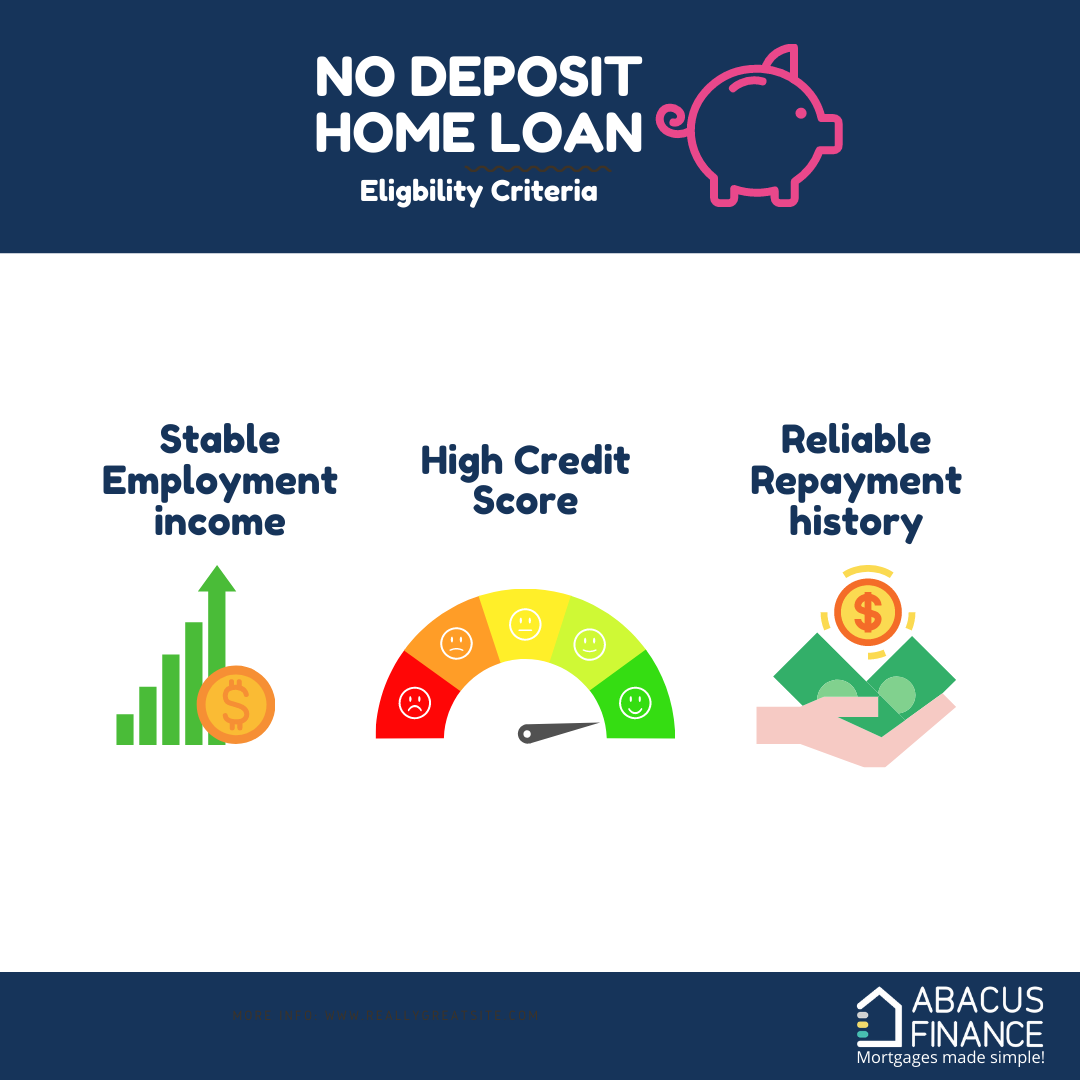

In Australia, only a few lenders offer a ‘no deposit’ loan option that’s attached with a strict eligibility criteria. Which includes the following:

– Stable employment income: No-deposit borrowers generally will be required to have a stable and consistent form of income, that’s sufficient to service the loan borrowings without any undue hardship.

– High credit score: Generally, borrowers must have a high credit score to be considered for a no deposit loan

– Reliable repayment history: In contrast, borrowers typically are required to show that they have been paying all current debts if applicable, such as personal loans, rent and credit card bills.

Depending on your financial situation, a no deposit or low deposit home loan may be a suitable option. Our lending specialist at Abacus Finance can help to tailor a home loan exactly to your needs.

What are the alternatives to no deposit home loans?

Even if you aren’t eligible for a no home loan payment as a first home buyer, there are alternatives you can consider.

1. First Homeowner Grants

For first home buyers, some state and territory governments in Australia offer grants that can be used for their initial home loan deposit. However, you still need to factor in upfront costs of buying a home, such as moving, legal expenses and stamp duty on the purchase if applicable.

Each state and territory have their own set of requirements and various grant amounts they can offer first home buyers.

2. A Family pledge guarantor loan

Some people can secure a home loan without a deposit by using an acceptable guarantor (parent, child or sibling) that’s acceptable to a lender. For example, your parents who own a home can act as a guarantor by offering part of their home equity to help top up your required cash deposit.

It’s important to keep in mind that, if you default on your loan it can put your guarantor’s property at risk. With every lender, the borrowing amounts and eligibility criteria will vary. So, you should consider your options carefully and seek professional advice if in doubt.

3. First Home Loan Deposit Scheme

Imagine receiving a loan with a deposit for as low as 5% without needing to pay for LMI. Luckily for eligible first home buyers, the government has created the First Home Loan Deposit Scheme(FHLDS). Where the government acts as a guarantor and secures the remaining deposit. This scheme is only available for a limited number of first home buyers a year.

How can we help you to reach your goals?

At Abacus finance we know that it’s possible to buy a home with a small deposit, but it can be difficult to know what choices are best suited for your specific needs. Our mortgage brokers can help to evaluate your options and provide viable alternatives and lenders that meet your needs.

The information in this post is general in nature and should not be considered personal or financial advice. You should always seek professional advice or assistance before making any financial decisions