What you need to know about the New Home Guarantee Scheme?

If owning a house was easy, every adult in the country would be a homeowner now. However, the rising prices of properties in the market get in the way of every aspiring homeowner. Not only that, but the required deposit relative to income is also a point of contention.

To back up the reality of the problem, the 2021 ANZ Housing Affordability Report shows the number of years it would take for a working adult to save up for a deposit. It also shows the portion of income relative to the ability to service rent.

If you live in Sydney and start putting away some money for a hose deposit, you will be able to get one in 2033. According to the data, it would take you 11.4 years to afford a house in the Sydney property market.

Melbourne comes to a close second at 10.1 years, Brisbane at 7.9 years, and Adelaide at 8.3 years. In Darwin, it’s 4.8 years. The data is based on the average income and the average prices of properties in the market of every state.

Is there no hope left for people who want to own a house as soon as possible? There is the Home Guarantee Scheme the government.

Keep reading to know how this works.

What is the New Home Guarantee Scheme?

The New Home Guarantee Scheme aims to solve the problem faced by aspiring homeowners with the deposit requirement for home loans. The average required deposit for mortgage loans is 20% of the property value.

Anyone who has less than that needs to pay a lender’s mortgage insurance (LMI), either through the duration of the loan term or upon settlement. The LMI is there to protect the lender from the possibility of the borrower defaulting the loan.

Through the New Home Guarantee Scheme, you may take out a loan from a participating lender, and part of the loan will be guaranteed by the government. This way, you can start owning a house with a deposit of as little as 5%.

As the National Housing Finance and Investment Corporation (NHFIC)guarantees up to 15% of the entire loan amount, you can also participate in other national programs for first home buyers. Take note that the amount guaranteed by the NHFIC is not good as a cash payment.

According to the latest budget statement, the NHFIC will receive additional funding of $2 billion to support more guarantees for 2022.

What are the eligibility requirements?

Australian citizens 18 years old and above can apply for the scheme. If you are single, your taxable income for the last financial year should amount to $125,000. For couples, the income must be up to $200,000 dollars to qualify. Couples must be married or in a de-facto relationship.

You must have at least 5% of the deposit required for the property you are eyeing and must have the intention of occupying the property yourself. The scheme does not cover investment properties. You must also never have owned a house before nor had an interest in a property prior to applying to the scheme.

Once you qualify repayments of the principal are scheduled and spread out over the term of the loan which can be up to 30 years.

The application should be coursed through any of the participating lenders. The NHFIC does not accept applications. You may see the list of all participating lenders here.

What kind of properties does the scheme cover?

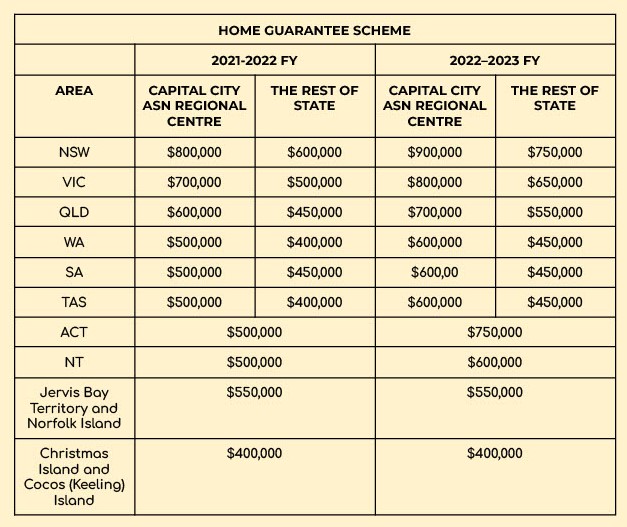

There is a property price cap set by the NHFIC per state. The highest property price available in the scheme is $950,000. This is for new houses in New South Wales’s capital city and regional centers.

Properties are more expensive in the cosmopolitan area so the Home Guarantee Scheme has an adjusted price cap. In the rest of NSW, the property price cap is at $600,000.

Aside from being within the property price cap, the house you choose must be any of the following :

- newly-constructed dwellings

- off-the-plan dwellings

- house and land packages

- land and a separate contract to build a new home

For each of these property classifications, different requirements apply. Upon pre-approval, if the property you are eyeing is a newly-constructed dwelling, you must enter into a contract of sale within 90 days. If you are building a new home, you must enter into a building contract within 90 days as well.

Communicate with a participating lender to know more about these requirements in detail. The participating lender will be the one to approve your eligibility under the scheme.